Domestic ore:

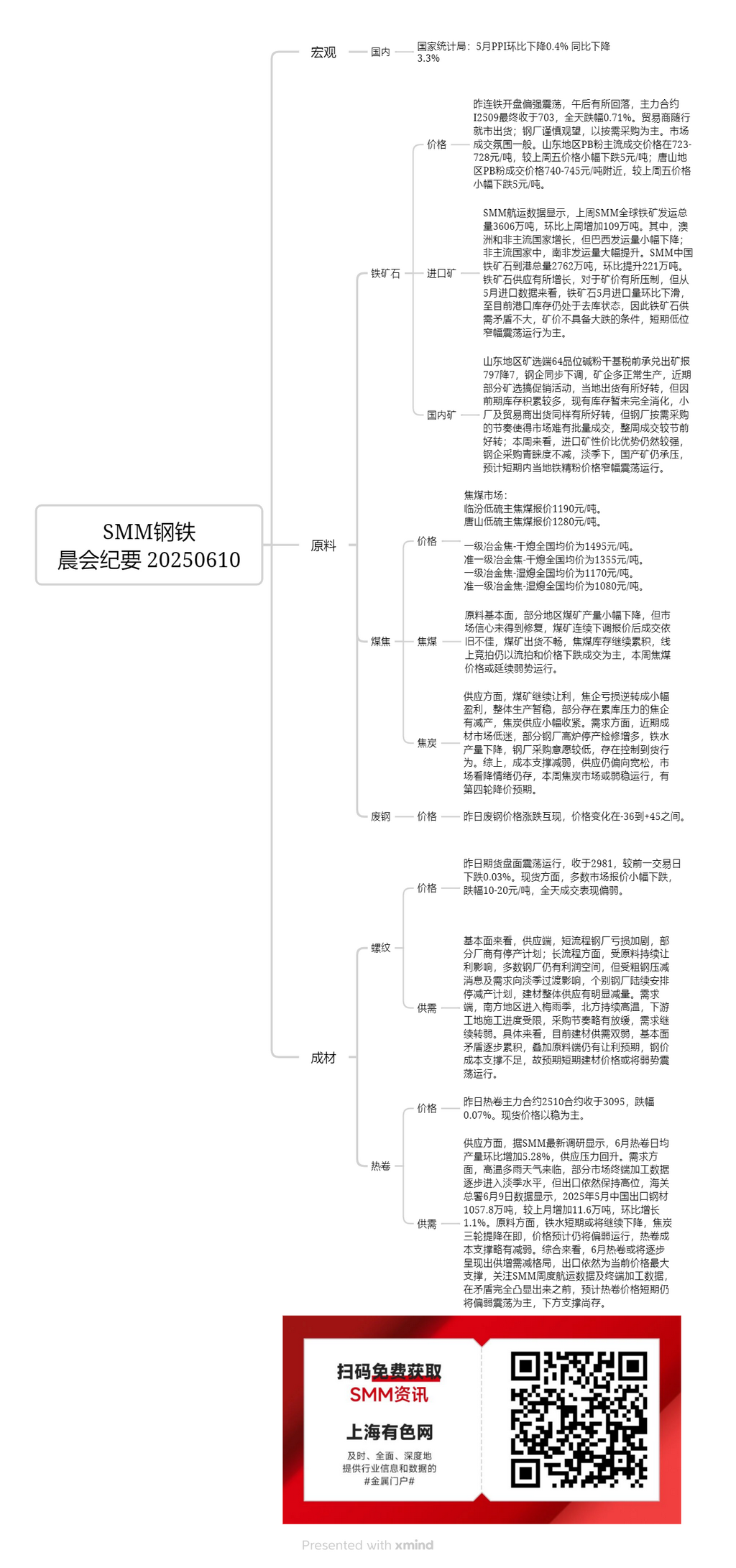

In Shandong, the ex-mine price (dry basis, tax excluded, acceptance) of 64-grade alkaline fines at mines and beneficiation plants was reported at 797 yuan/mt, down 7 yuan/mt. Steelmakers followed suit with price reductions. Most miners maintained normal production. Recently, some mines and beneficiation plants launched sales promotions, leading to improved local shipments. However, due to significant inventory buildup in the earlier period, existing inventory has not been fully depleted. Shipments from small mills and traders also improved somewhat, but the steel mills' purchasing-as-needed approach made it difficult for the market to achieve bulk transactions. Overall, trading activity improved compared to the period before the holiday. This week, imported ore continues to offer a strong cost-performance advantage, and steelmakers' preference for it remains unabated. Amid the off-season, domestic ore still faces downward pressure. It is expected that the price of local iron ore concentrates will fluctuate rangebound in the short term.

Coking coal:

On the raw material fundamentals side, coal mine production in some regions declined slightly, but market confidence has not recovered. Despite consecutive price reductions by coal mines, trading activity remains sluggish, with poor shipments from coal mines. Coking coal inventory continues to accumulate. Online auctions are still dominated by failed bids and transactions at lower prices. This week, coking coal prices may continue to be in the doldrums.

Coke:

In terms of supply, coal mines continue to offer price concessions, enabling coke producers to reverse losses into small profits. Overall production remains stable for the time being. Some coke producers facing inventory buildup pressure have cut production, leading to a slight tightening of coke supply. On the demand side, the finished steel market has been sluggish recently, with an increase in blast furnace shutdowns and maintenance at some steel mills. Pig iron production has declined, and steel mills' purchase willingness is low, with some taking measures to control arrivals. In summary, cost support has weakened, supply remains relatively loose, and market sentiment for price declines persists. This week, the coke market may remain in the doldrums, with expectations for a fourth round of price reductions.

Rebar:

Yesterday, the futures market fluctuated, closing at 2,981, down 0.03% from the previous trading day. On the spot cargo side, quotes in most markets dropped slightly, with declines of 10-20 yuan/mt. Trading activity was weak throughout the day.

From a fundamental perspective, on the supply side, losses at EAF steel mills have intensified, with some producers planning production shutdowns. In the long-process sector, affected by continuous price concessions from raw materials, most steel mills still have profit margins. However, influenced by news of crude steel production cuts and the transition to the off-season in demand, some steel mills have gradually arranged production shutdowns and reductions, leading to a significant decrease in the overall supply of construction materials. On the demand side, the plum rain season has arrived in southern China, and northern regions continue to experience high temperatures, limiting construction progress at downstream sites. The purchasing pace has slowed slightly, and demand continues to weaken. Specifically, the current construction materials market is characterized by weak supply and demand, with fundamental contradictions gradually accumulating. Coupled with expectations for further price concessions from raw materials, cost support for steel prices is insufficient. Therefore, it is expected that construction material prices may remain in the doldrums in the short term.

HRC

Yesterday, the most-traded hc2510 futures contract closed at 3,095, down 0.07%. Spot prices remained stable overall. In terms of supply, according to the latest survey by SMM, the daily average production of HRC increased by 5.28% MoM in June, indicating a rebound in supply pressure. On the demand side, with the arrival of hot and rainy weather, terminal processing data in some markets gradually entered off-season levels. However, exports remained high. Data from the General Administration of Customs on June 9 showed that China exported 10.578 million mt of steel in May 2025, an increase of 116,000 mt MoM, up 1.1% MoM. In terms of raw materials, pig iron production may continue to decline in the short term, and a third round of coke price cuts is imminent, with prices expected to remain in the doldrums. As a result, the cost support for HRC has slightly weakened. Overall, the HRC market in June may gradually exhibit a pattern of increasing supply and decreasing demand. Exports remain the biggest support for current prices. Attention should be paid to SMM's weekly shipping data and terminal processing data. Before contradictions fully underscore, it is expected that HRC prices will remain in the doldrums in the short term, with some underlying support still in place.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)